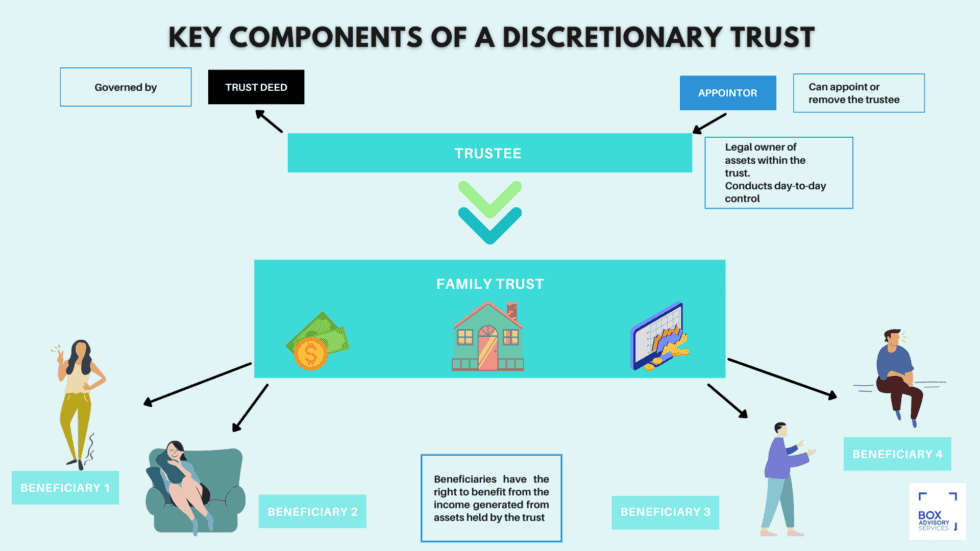

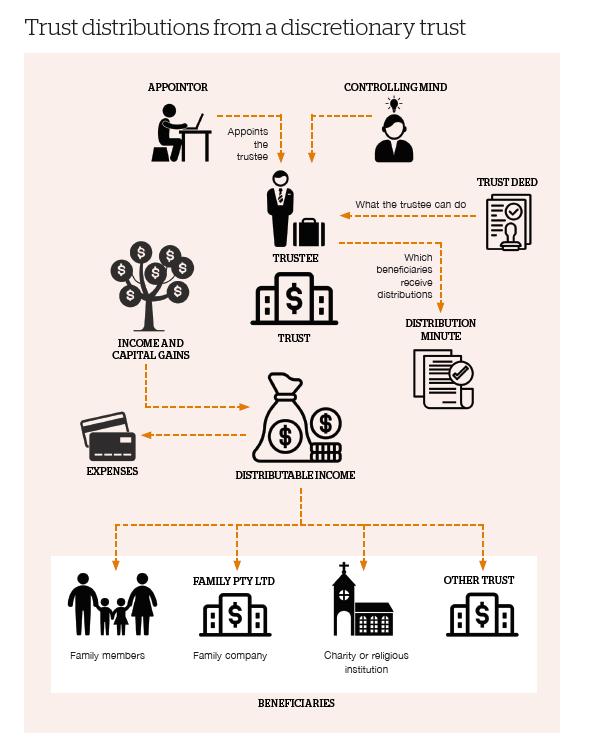

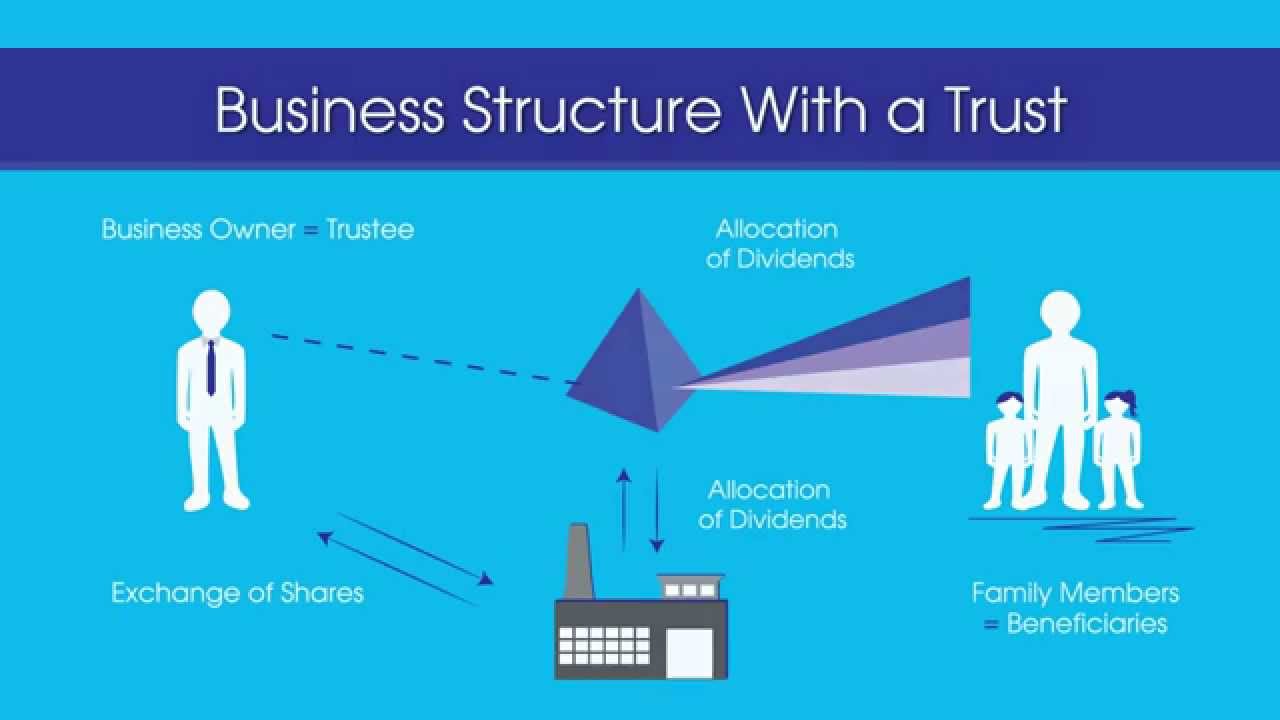

1. Discretionary Trusts. A discretionary trust is the most common type of trust in Australia. In the case of a discretionary trust, the trustee is given complete discretion as to how the trust income is distributed to the beneficiaries. Generally, the trustee can change how the trust income is distributed each year.. A family trust is a type of trust generally established by someone during their lifetime for the benefit of their 'family group'. It is a discretionary trust and can be used to hold assets, run a family business, manage certain investments and support beneficiaries. This type of trust structure is typically established for tax effectiveness.

The Perfect Startup Strategy Series 4 Choosing Business Structure in Australia Inkjet

PPT ISSUES FACING THE AUSTRALIAN NATIONAL TRUSTS IN 2013 AND BEYOND PowerPoint Presentation

Understanding the Different Trusts in Australia YouTube

An overview of trusts in Australia

An Overview of Trusts in Australia Equity & Law Wealth

Trusts in Australia You Need to Know A Comprehensive Guide

Family trusts explained for Australians YouTube

Discretionary Trusts Everything You Need to Know BOX Advisory Services

Testamentary Trust Template Australia Master of Documents

Vestey trust Australia Read about the Vestey trust system DG Institute

Trust Structure Avia Financial

What is a Trust

Trust distributions from a discretionary trust — CE Smith & Co. Mackay

Funds Management Sophie Grace

Family Trust Australia Explained Pros & Cons YouTube

Trust Planning for Private Business Owners YouTube

Testamentary Trust Template Australia Master of Documents

50 Years of National Trust of Australia

Types of Trusts Durfee Law Group

What is a testamentary trust? Australian Wills Will Wizard YouTube

In Australia, a private trust can operate for up to 80 years. The duration of the trust is generally set by the trust deed, which can specify a shorter term. The term can be based on the happening of a specific event, e.g. the date that someone dies or reaches a specific age. The end date of a trust is usually called the 'vesting.. A trust is an obligation imposed on a person or other entity to hold property for the benefit of beneficiaries. Trusts, trustees and beneficiaries An overview of the role of trusts, trustees and beneficiaries.