If you have a variable interest rate, paying attention to the federal funds rate can help you predict what your interest rate will do. The amount you borrow. The more you borrow from your bank, the more interest you'll need to repay. For example, 5% of $1 million will always be a larger amount than 5% of $500,000. The outstanding loan amount.. An interest-only mortgage is a type of loan where you only need to pay the interest portion of your loan principal—at first. In most cases, interest-only loans begin with a designated period.

Debt recovery interest calculator IrvinLindsay

How To Calculate Home Loan Interest? Malaysia Housing Loan

Home Loan Interest Rates Of Top Banks Loanfasttrack

How To Calculate Interest Paid On A Loan And Principal Paid

4 Ways to Calculate Interest wikiHow

How Do I Calculate The Interest Paid On A Loan

How To Find Out Interest Rate Plantforce21

3 Ways to Calculate Mortgage Interest wikiHow

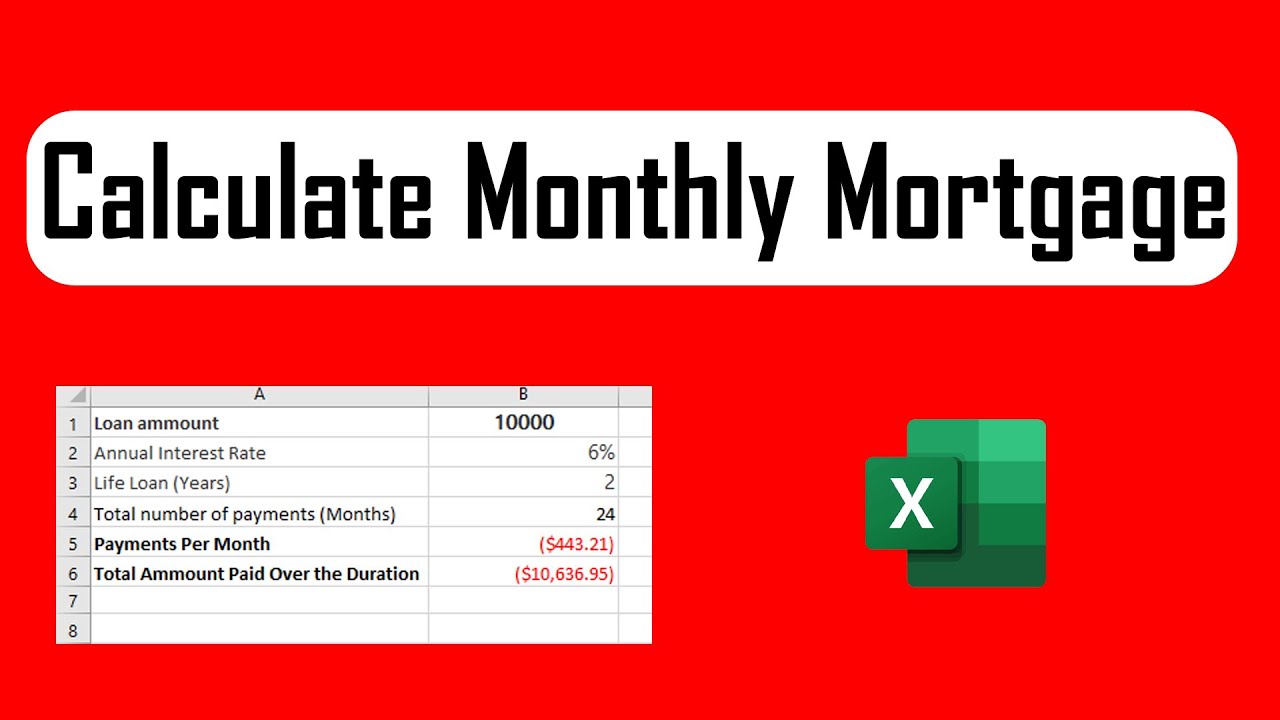

How To Calculate Your Monthly Mortgage Payment Given The Principal, Interest Rate, & Loan Period

How to calculate loan interest

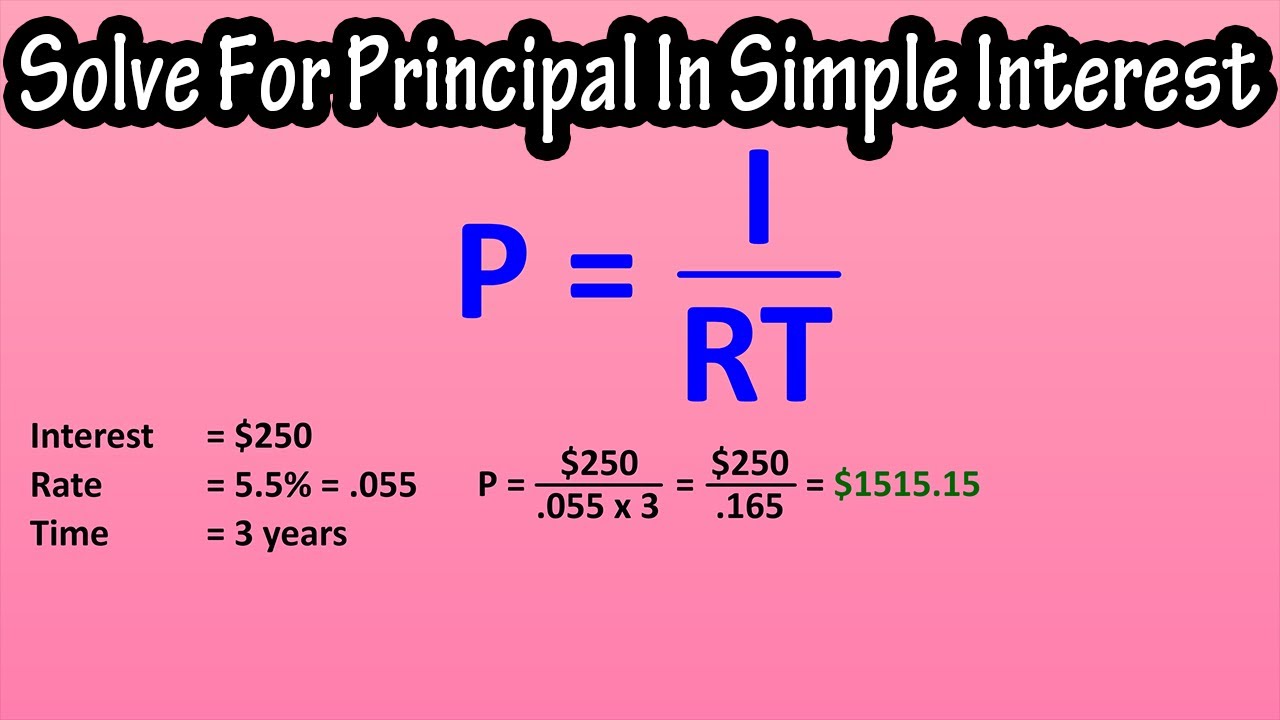

How To Calculate, Solve For, Or Find Principal In Simple Interest Formula For Simple Interest

How to Calculate Interest on a Loan TheStreet

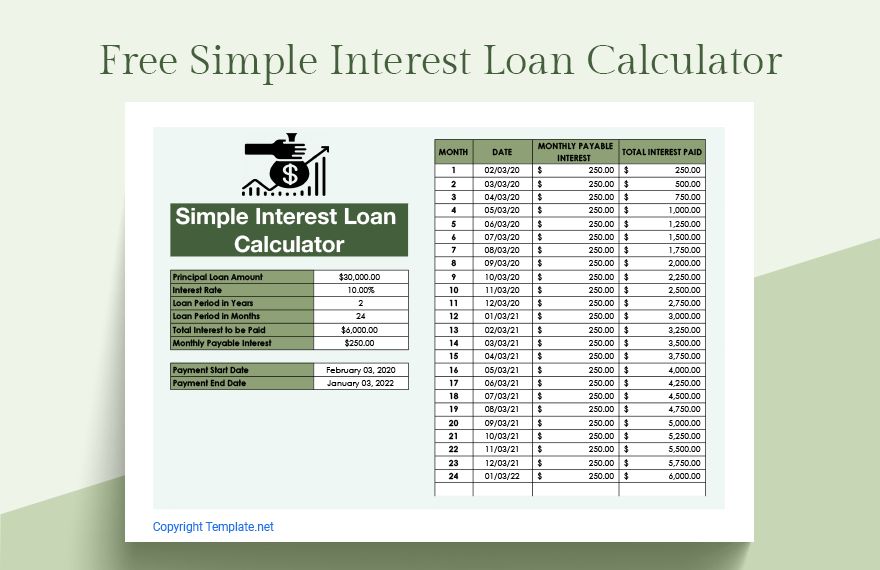

Free Simple Interest Loan Calculator Google Sheets, Excel

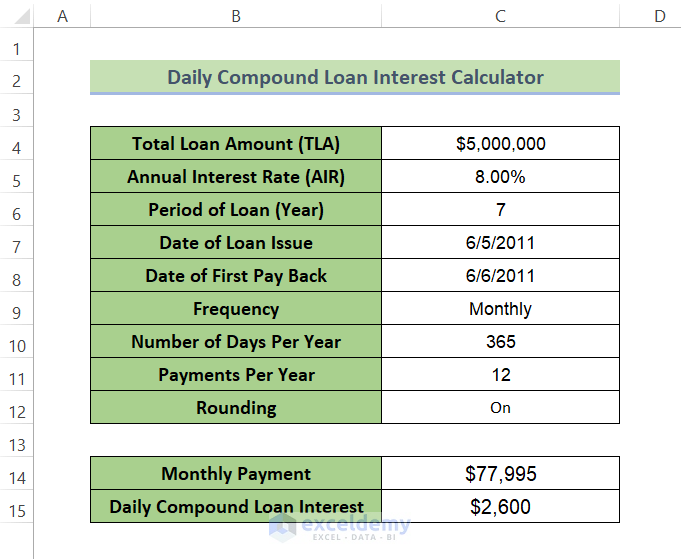

Calculate payment for a loan Excel formula Exceljet

How To Calculate The Monthly Interest and Principal on a Mortgage Loan Payment YouTube

How To Calculate A Mortgage Payment Amount Mortgage Payments Explained With Formula YouTube

How To Calculate Loan Interest? All You Need To Know Insurance Noon

43+ how to calculate mortgage payment in excel FauveFinlaec

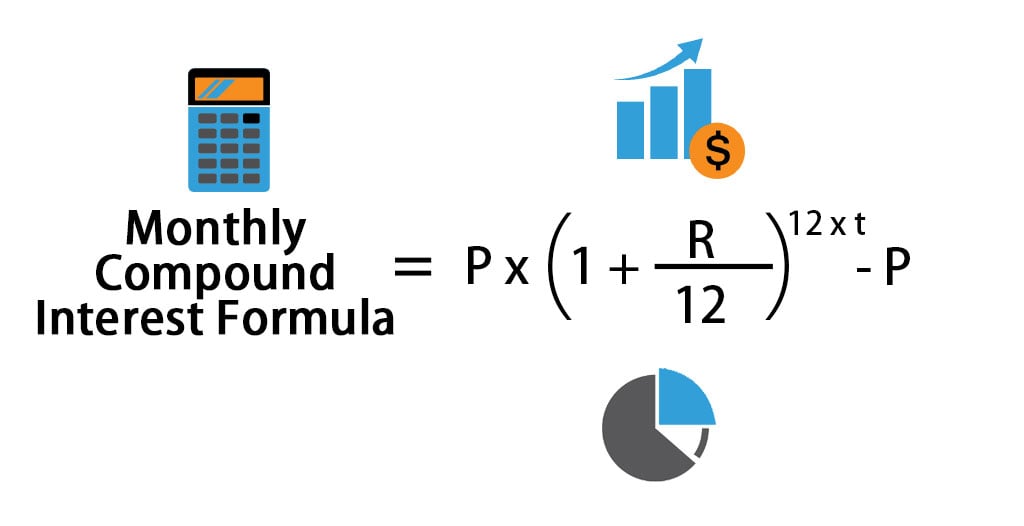

How To Calculate Compound Interest On A Loan Monthly Info Loans

:max_bytes(150000):strip_icc()/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png)

Compute Loan Interest With Calculators or Templates

Loan Term (in Years): 30 years. Interest Rate: 5.0%. Assuming you pay off the mortgage over the full 30 years, you will pay a total of $279,767.35 in interest over the life of the loan. That is almost the original loan amount! If we compare that to a 4.0% interest rate, the total interest paid would be $215,608.52.. The 4.5% annual interest rate translates into a monthly interest rate of 0.375% (4.5% divided by 12). So, you'll pay 0.375% interest each month on your outstanding loan balance. When you make your.