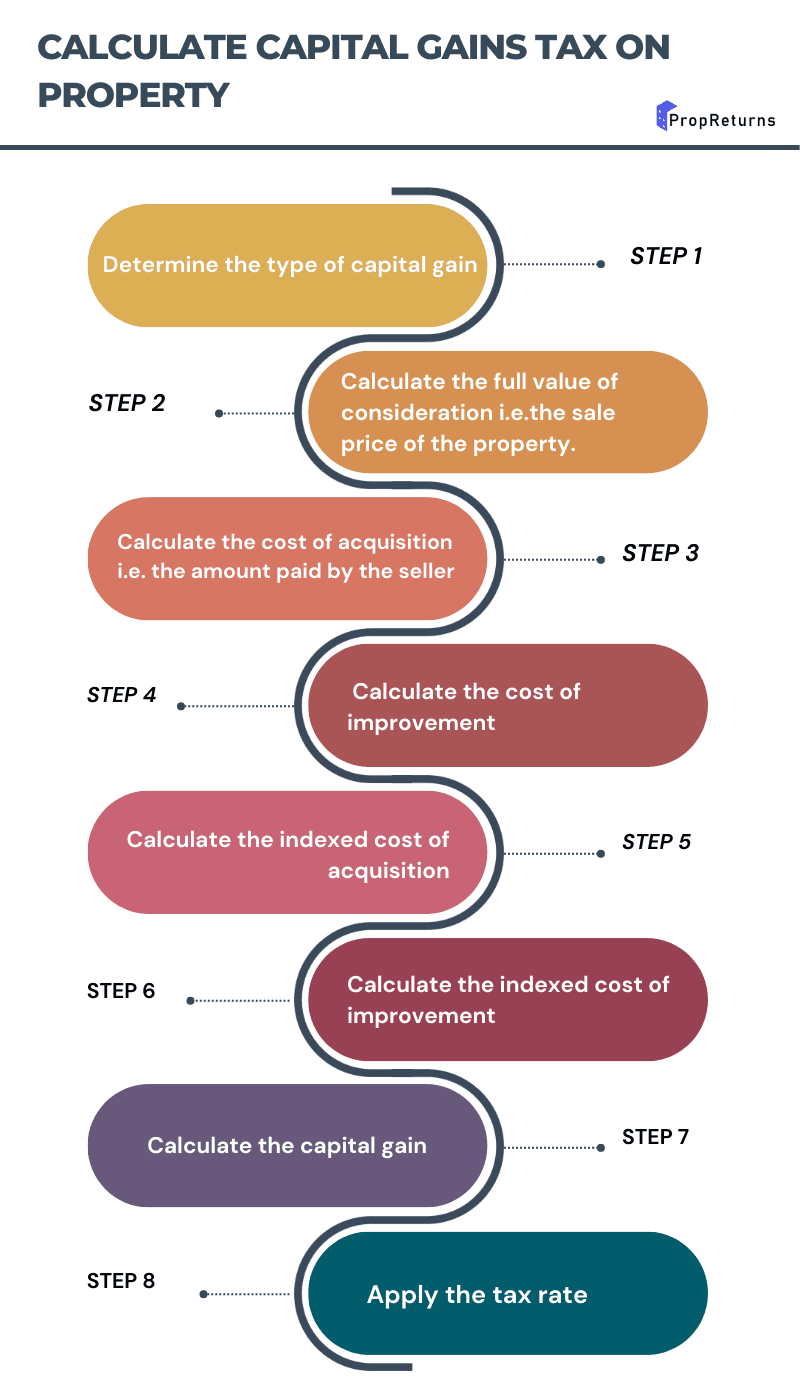

Schedule D (Form 1040) Capital Gains and Losses. 1040 U.S. Individual Income Tax Return. 1040-X Amended U.S. Individual Income Tax Return. 1099-A Acquisition or Abandonment of Secured Property.. If the buyer returns the property in the same tax year of sale, no gain or loss is recognized. This cancellation of the sale in the same tax year it.. A taxpayer who sells an immovable property or land should report such income or loss as Capital Gains in the Income Tax Return and pay tax on it at the applicable rate. Capital Gain Tax on the sale of property or land is determined based on the nature of the capital gains i.e. long-term or short-term. Capital Gain can be of two types depending.

Juno A Guide to Real Estate Capital Gains Tax

![[Video] How To Calculate Capital Gains Tax on Real Estate Investment Property? [Video] How To Calculate Capital Gains Tax on Real Estate Investment Property?](https://i0.wp.com/d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/How-To-Calculate-Capital-Gains-Tax-Real-Estate.png?fit=1200%2C628&ssl=1)

[Video] How To Calculate Capital Gains Tax on Real Estate Investment Property?

All You Need to Know About Capital Gains and Taxes on Sale of Property in India

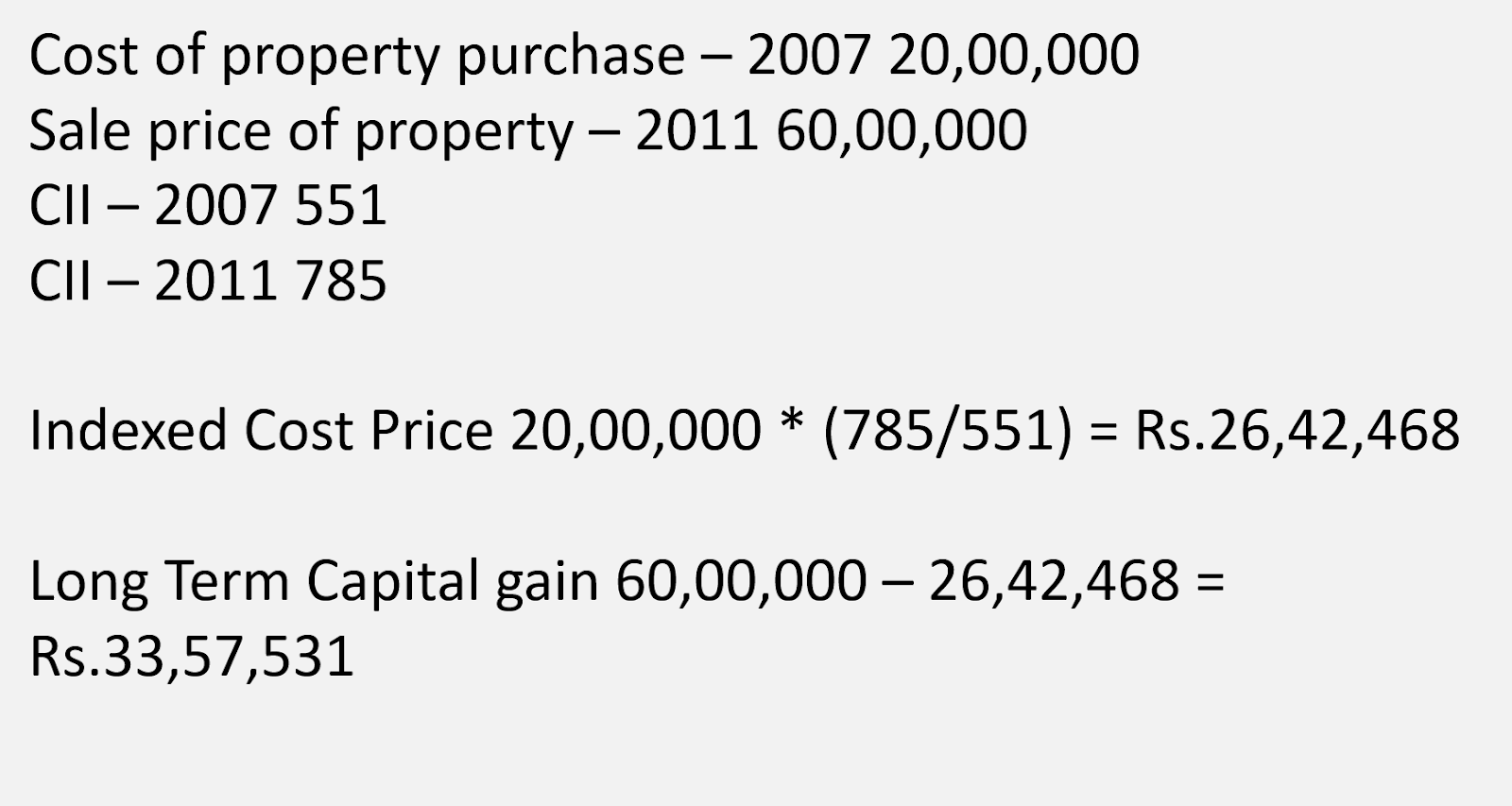

How to Calculate Long Term Capital Gain on Property/House Sale With Indexation Example

What is Capital gain Tax on Agricultural Land?

How to Calculate Capital Gain on House Property? Yadnya Investment Academy

Capital Gains Tax on a Sale of a Property

Capital Gain Tax Long Term Capital Gains & Short Term Capital Gains

Capital Gains Tax Explained PropertyInvestment flip investing knowthenumbers Capital gains

Calculating Capital Gains Tax On Al Property Australia Bios Pics

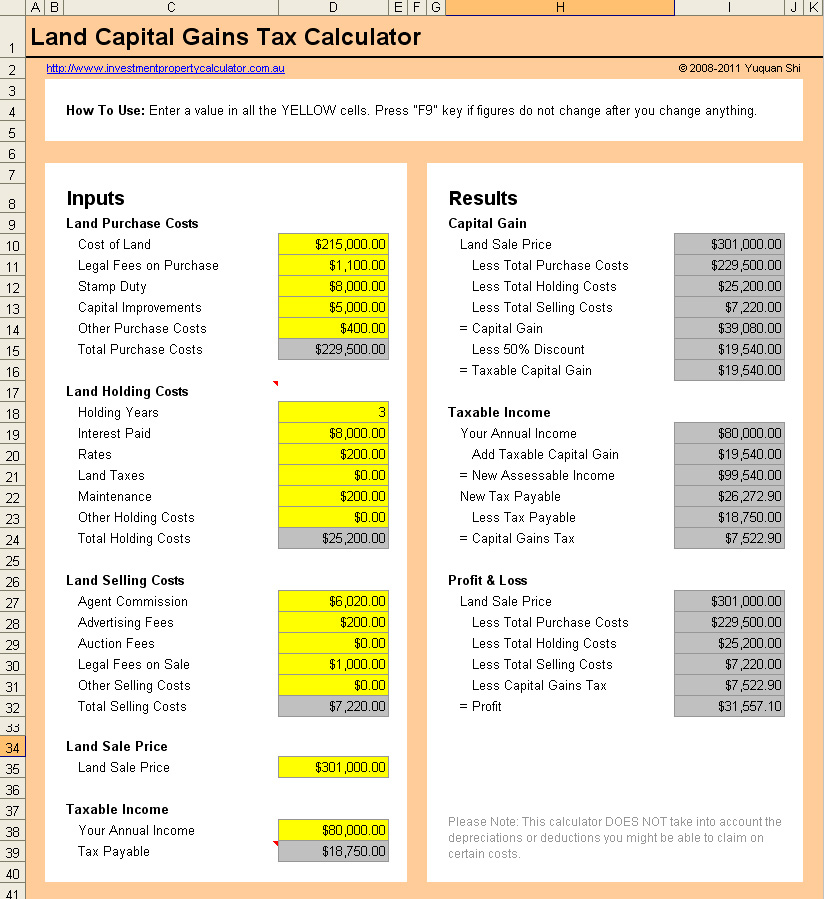

Free Land Capital Gains Tax Calculator

The Beginner's Guide to Capital Gains Tax + Infographic Transform Property Consulting

How to Avoid Capital Gains Tax on a Land Sale

How to save CAPITAL GAINS TAX on sale of Plot/ Flat/House?

Capital Gain on sale of Agricultural Land Tax Exemptions AssetYogi

PPT what is the capital gain tax on sale of property PowerPoint Presentation ID11553089

Capital Gains Taxes on Land Sale Concept Real Estate Concept with a Vacant Land Available for

Land Contracts and Capital Gains What You Need to Know

How to Save Capital Gain Tax on Property Sale?

Capital Gain on Sale of Land Tax Exemption Rules

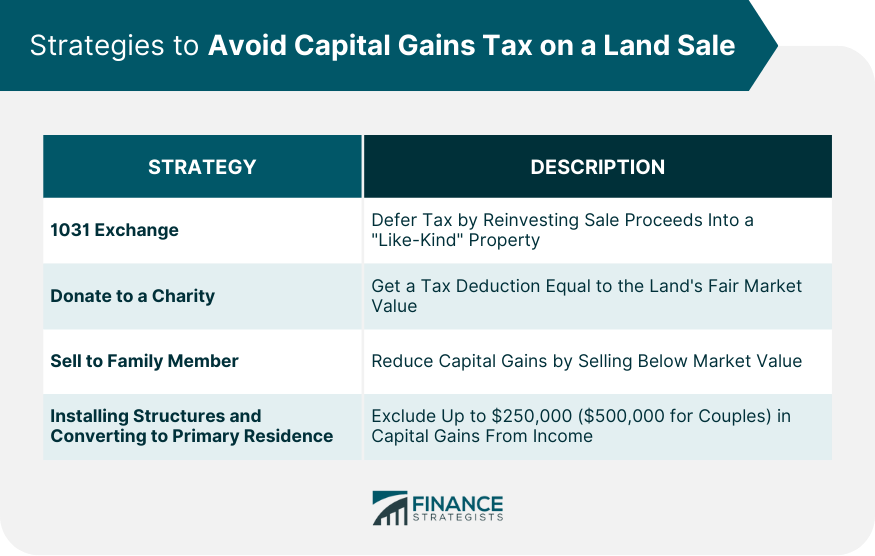

If you realize long-term capital gains from the sale of collectibles, such as precious metals, coins or art, they are taxed at a maximum rate of 28%. Remember, short-term capital gains from.. Avoiding capital gains tax on a land sale requires strategic planning. Firstly, consider a 1031 exchange, which allows you to defer tax by reinvesting the proceeds from the sale into a similar, or "like-kind," property. However, specific rules and timelines apply. Alternatively, invest in Qualified Opportunity Zones (QOZs).