No more rent increases. When homebuyers purchase a home with a fixed rate mortgage, the payment for the principal and interest on their mortgage stays the same for the life of the loan, unlike.. HUD says a first-time buyer is an individual who has had no ownership in a principal residence during the 3-year period ending on the date of purchase of the property. This includes a spouse (if.

FirstTime Home Ownership Made Easy, Thanks To A New Offer from Frank Salt* Frank Salt Real Estate

Can firsttime buyers get a buytolet mortgage? Mortgages Explained YouTube

FirstTime Buyers are Gravitating Toward Smaller Homes

Day In The Life SHOWING HOMES TO FIRSTTIME BUYERS Real Estate Agent 36 YouTube

How Can First Time Buyers Get On The Property Ladder? Faded Spring

Nationwide to Lend Remortgagers 6.5x

Can First Time Buyers Rent Their Property?

![Keeping Current Matters Renting vs. Buying What Does it Really Cost? [INFOGRAPHIC] Keeping Current Matters Renting vs. Buying What Does it Really Cost? [INFOGRAPHIC]](https://d3sj2vq3d2xms.cloudfront.net/wp-content/uploads/2016/05/07163416/Rent-vs.-Buy-KCM.jpg)

Keeping Current Matters Renting vs. Buying What Does it Really Cost? [INFOGRAPHIC]

Mortgage president’s advice to weary firsttime buyers Mortgage Professional

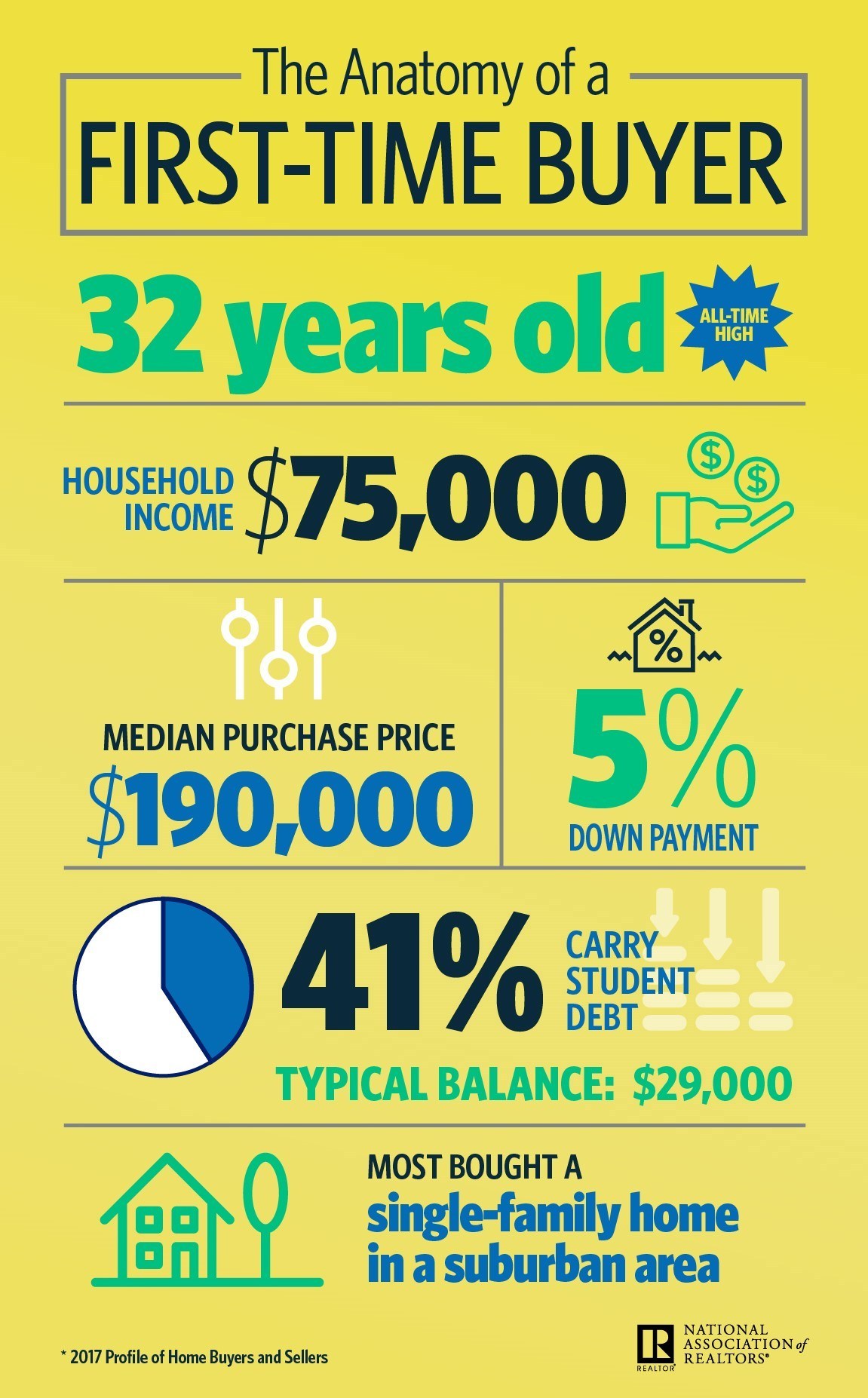

Infographic Breaking Down FirstTime Buyer Data RISMedia\'s Housecall

First Time Buyers Mortgage Advice Fosters Financial

10 Tips for New Home Buyers Peter & Sharon Bare Realty Group

First Time Buyers, Find a mortgage, Purchases, Remortgages, Help to Buy, Buy to Let, Insurance

Our Best First Time Buyer Mortgage Rates December 2022 money.co.uk

First time buyer? Here’s 8 mortgages, schemes and options to consider Mortgage Confidence

Pin on Real Estate Advice and Tips.

Where Can Renters Afford to FirstTime Buyers? The New York Times

Home Insurance for FirstTime Home Buyers TimesProperty

The Benefits of Selling to a FirstTime Buyer and How to Attract Them

The FirstTime Home Buyer Checklist ScoreMaster®

If you open one and contribute up to $8,000—the maximum annual FHSA contribution limit—this year and again in the new year, you'll have up to $16,000 of tax deductible contributions that can.. The answer is yes! In fact, a popular strategy known as "rentvesting" allows first-time homebuyers to purchase an investment property they can afford and continue renting in their desired location. Rentvesting provides several benefits for first-time buyers who want to enter the property market while maintaining their preferred living.